Although you have seen the job order costing system using both T-accounts and job cost sheets, it is necessary to understand how these transactions are recorded in the company’s general ledger. For example, in January, we have total labor costs of $100,000 which include the direct labor cost of $90,000 and the indirect labor cost of $10,000. When materials are requisitioned for manufacturing, all materials are credited out of the Raw Materials inventory account. Direct materials are debited into the Work In Process inventory account and indirect materials are debited to the Manufacturing Overhead account.

- In job order costing, the manufacturing overhead is the cost that is related to the production operation as a whole but cannot be directly assigned to specific jobs.

- Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

- And, this account usually includes both the direct raw materials and the indirect raw materials.

Video Illustration 2-3: Applying manufacturing overhead to jobs LO4

Direct labor costs are manufacturing labor costs that can be easily and economically traced to the production of the product. Indirect labor costs are manufacturing labor costs that cannot be easily and economically traced to the production of the product, e.g. the production supervisor’s salary or quality control. Due to the practical difficulties of using actual costing, many companies instead use a normal costing system to obtain a close approximation of the costs on a timelier basis, especially manufacturing overhead costs. Direct materials and direct labor are much more feasible in terms of access to actual costs from materials requisition forms and labor time sheets, while manufacturing overhead costs pose difficulties in determining actual costs. Indirect materials also have a materials requisition form, but the costs are recorded differently.

7: Prepare Journal Entries for a Job Order Cost System

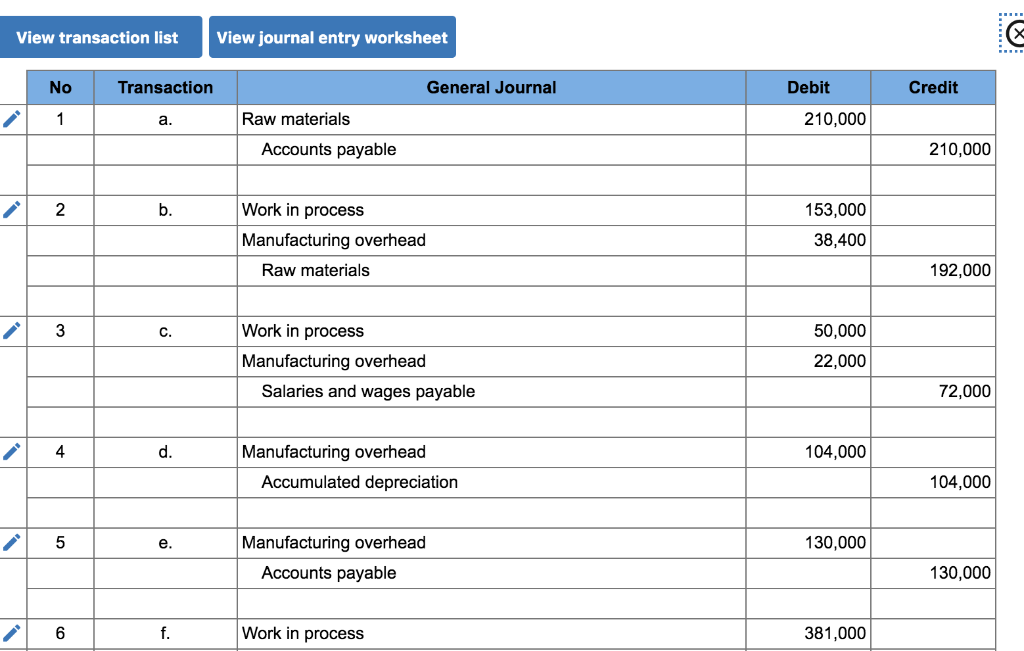

The predetermined manufacturing overhead rate is computed before the period starts, usually at the beginning of a year or quarter. Manufacturing overhead is then applied to the jobs as the work is completed throughout the year. In a job-order costing system, the predetermined overhead rate is applied to the jobs based on the job’s actual use of the allocation base or cost driver used to calculate the predetermined rate. The following example will expand upon the new property tax rebate program previously presented and add other transactions in the manufacturing cycle. These include purchasing raw materials, recording jobs completed, selling finished jobs, and adjusting estimated to actual factory overhead incurred.

Example for applying overhead cost to production

Once a product is sold, it is no longer an asset in the organization’s possession. At that point, the costs to manufacture the product are moved from the Finished Goods inventory asset account to the Cost of Goods Sold account. At the same time, the revenue collected from the sale is recorded in the Sales revenue account. The sales revenue less the cost of goods sold equals the gross profit made on the product.

The company assigns overhead to each job on the basis of the machine-hours each job uses. Overhead is assigned to a job at the rate of $ 2 per machine-hour used on the job. Job 16 had 875 machine-hours so we would charge overhead of $1,750 (850 machine-hours x $2 per machine-hour).

Job Order Costing versus Process Costing

Compute the departmental predetermined manufacturing overhead rates for the fabrication and finishing departments. Notice, Job 105 has been moved from Finished Goods Inventory since it was sold and is now reported as an expense called Cost of Goods Sold. Also, did you notice that actual overhead came to $9,800 ($1,000 indirect materials + $2,000 indirect labor + $6,800 other overhead from transaction g) but we applied $9,850 in overhead to the jobs in transaction d? Whenever we use an estimate instead of actual numbers, it should be expected that an adjustment is needed. We will discuss the difference between actual and applied overhead and how we handle the differences in the next sections. Notice, Job 105 has been moved from FinishedGoods Inventory since it was sold and is now reported as an expensecalled Cost of Goods Sold.

The predetermined manufacturing overhead rate is $95 per machine hour (total estimated overhead $197,600 / 2,080 total estimated machine hours). Gross profit for the job is calculated as the sales revenue collected from the customer less the cost of the goods sold. In a job-order costing system, cost of goods sold represents total production costs, e.g. direct material, direct labor, and manufacturing overhead. When a job is finished, the total costs for the job are moved from the Work In Process inventory account (credit) to the Finished Goods inventory account (debit).

The most common mistake when preparing a job order sheet is the use of the wrong job order number.

When the production is finished, we can transfer the costs in the work in process inventory account to the finished goods inventory. This is the last step in job order costing before the finished goods are available to be sold to customers. In this stage of job order costing, we usually apply the overhead cost after calculating the predetermined overhead rate. In other words, the applied overhead cost that we record in this stage is usually an estimated amount, not an actual amount of overhead that occurred. Job order costing systems assign costs directly to the product by assigning direct materials and direct labor to the work in process (WIP) inventory. As you learned previously, direct materials are the components that can be directly traced to the products produced, whereas direct labor is the labor cost that can be directly traced to the products produced.

The three costs of production are direct materials, direct labor, and factory overhead. For unique products, each job accumulates different amounts of each of these three costs. An analogy would be several patients in a doctor’s office — each person has different symptoms and therefore receives different treatments, medications, and tests from the same doctor. Each person’s total medical bill is like a “tab” that the patient has run up with the doctor. An allocation base or cost driver is a production activity that drives costs such as direct labor hours, machine hours, direct labor dollars, or direct material dollars.