A common size statement analysis lists items as a percentage of a common base figure. Creating financial statements in this way can make it much easier when it comes to comparing companies, or even comparing periods for the same company. The balance sheet of a company gives an overview of shareholders’ equity, assets, and liabilities for a reporting period. A common size balance sheet analysis gets created with the same rationality as the common size income statement.

You’re our first priority.Every time.

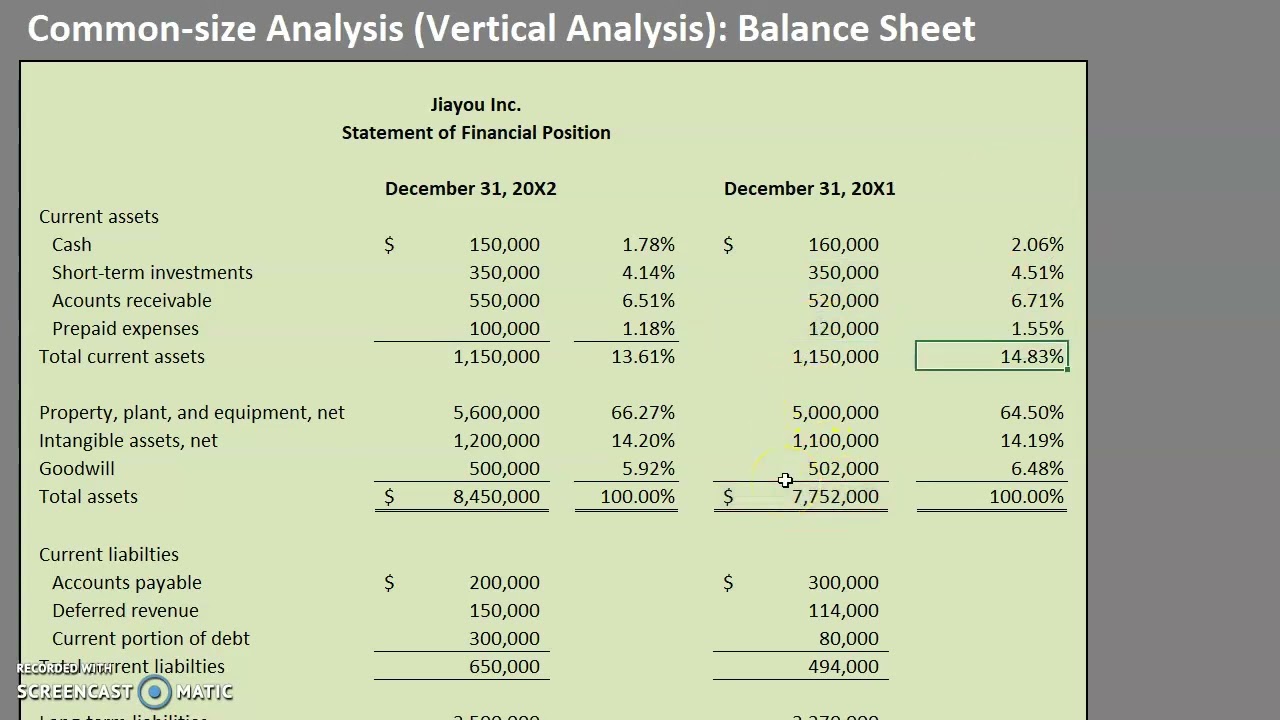

Now, if you want to analyze your income statement with another period or company’s income statement, you do not need to calculate all the figures because you can compare your percentages. Using Clear Lake Sporting Goods’ current balance sheet, we can see how each line item in its statement is divided by total assets in order to assemble a common-size balance sheet (see Figure 5.22). The cash flow statement provides an overview of the firm’s sources and uses of cash. The cash flow statement is divided among cash flows from operations, cash flows from investing, and cash flows from financing. Each section provides additional information about the sources and uses of cash in each business activity.

What Is Included in the Balance Sheet?

- You can also look to determine an optimal capital structure for a given industry and compare it to the firm being analyzed.

- This tool is especially important if you’re using key performance indicators to measure your business’s performance and profitability.

- A short-term drop in profitability could indicate just a speed bump rather than a permanent loss in profit margins.

- The percentages calculated by taking the respective common bases are then compared with the corresponding percentages of other periods, through which meaningful conclusions can be drawn.

The term balance sheet refers to a financial statement that reports a company’s assets, liabilities, and shareholder equity at a specific point in time. Balance sheets provide the basis for computing rates of return for investors and evaluating a company’s capital structure. One version of the common size cash flow statement expresses all line items as a percentage of total cash flow. The common size balance sheet format is useful for comparing the proportions of assets, liabilities, and equity between different companies, particularly as part of an industry analysis or an acquisition analysis.

AccountingTools

This information can be useful in making investment decisions, identifying areas of financial strength and weakness, and developing strategies to improve financial performance. Despite its limitations, common size analysis is still crucial for understanding how each financial element affects the overall structure of a company. Common-size statements are highly valued because not only do they include the traditional common size balance sheet example financial data but also offer a more comprehensive look into the health of any firm. The balance sheet provides a snapshot overview of the firm’s assets, liabilities, and shareholders’ equity for the reporting period. A common size balance sheet is set up with the same logic as the common size income statement. The balance sheet equation is assets equals liabilities plus stockholders’ equity.

There’s also a separate version of the common size balance sheet where any current asset line items are listed as a percentage of the total assets. It would work the same with liabilities listed as a percentage of total liabilities. It also includes stockholders equity being listed as a percentage of total stockholders equity. A common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets, total liabilities, and equity accounts. Common size balance sheets are used by internal and external analysts and are not a reporting requirement of generally accepted accounting principles (GAAP). A common size income statement is used to analyze each income and expense item as a percentage of total revenue, facilitating easy comparison of financial performance over time or against other companies.

A company has $8 million in total assets, $5 million in total liabilities, and $3 million in total equity. Therefore, along with reporting the dollar amount of cash, the common size financial statement includes a column that reports that cash represents 12.5% ($1 million divided by $8 million) of total assets. A common size balance sheet allows for the relative percentage of each asset, liability, and equity account to be quickly analyzed. Likewise, any single liability is compared to the value of total liabilities, and any equity account is compared to the value of total equity.

The liabilities section is broken out similarly as the assets section, with current liabilities and non-current liabilities reporting balances by account. The total shareholder’s equity section reports common stock value, retained earnings, and accumulated other comprehensive income. Apple’s total liabilities increased, total equity decreased, and the combination of the two reconcile to the company’s total assets. Using this statement, users could quickly see the percentage of each item, cash or account receivable, compared to total assets. The same process would apply on the balance sheet but the base is total assets.

Without knowing which receivables a company is likely to actually receive, a company must make estimates and reflect their best guess as part of the balance sheet. The most significant benefit of a common-size analysis is that it can let you identify large or drastic changes in a firm’s financials. Rapid increases or decreases will be readily observable, such as a fast drop in reported profits during one quarter or year.

The company should look for ways to cut costs and increase sales in order to boost profitability. And, just like with the income statement, we must compare our numbers with the industry’s averages or with major competitors. Each line item on a balance sheet, statement of income, or statement of cash flows is divided by revenue or sales. You might be able to find them on the websites of companies that specialize in financial analysis.