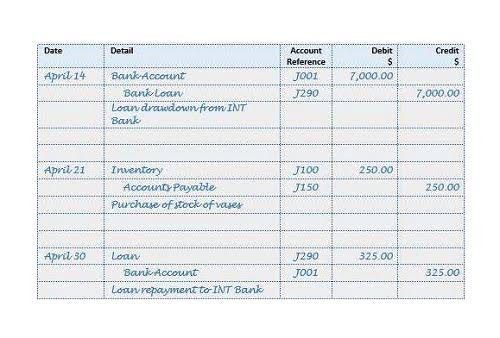

The batch is received and sorted by a clearinghouse, which sends individual transactions out to receiving banks. Each receiving bank deposits the money into the recipient’s account. Bank transfers in the U.S. are commonly considered to be wire transfers ACH transfer (between two financial institutions) and ACH transfers (that go over the Automated Clearing House network).

What is an ACH transaction?

The receiving bank may also hold the funds as long as they’re allowed for security reasons. Unlike wire transfers, which often require you to pay a fee per transaction, there’s generally no fee to send or receive payments via ACH transfers. Think of all the time and money you save by not having to go to the bank to deposit a paycheck. And when you use ACH for online bill payments, you avoid the need to buy stamps and envelopes. Wire transfers can be sent domestically or internationally, and banks can charge fees for both types of transactions.

Are There Any Disadvantages to Automated Clearing House Transactions?

Domestic wires can take as long as a few hours, or overnight if a cutoff is missed. ACH transfers can be as fast as approximately 2.5 hours if the file is sent right before a same-day transfer window shuts. Overall, it’s important to remember that the wire network processes transactions in real time, while the ACH network processes transactions at set intervals. For contra asset account example, Chase charges $2.50 per ACH transfer for the first 10 payments and $0.15 for each additional transfer.

- Businesses can accept payments by ACH remotely, although the same is true for credit cards.

- Check with your bank to get the latest details on how it handles ACH transactions.

- Your bank or credit union will likely let you send more money than that in your ACH transfers through them.

- The base price for an ACH transaction is the network fee, which is fractions of a penny.

- Your bank sends the payment to the credit card company as scheduled.

Nacha

Wire transfers are processed in real time, as opposed to ACH payments, which are processed in batches three times a day. As a result, wire transfer funds are guaranteed to arrive on the same day, while ACH funds can take several days to process. While some banks don’t charge for wires, in some cases, they can cost customers up to $60. ACH and wire transfers are both electronic payment methods used for transferring funds between financial institutions.

- In partnership with three expert business owners, the PayPal Bootcamp includes practical checklists and a short video loaded with tips to help take your business to the next level.

- «They will charge as much as 50 cents per transaction (as a flat rate). In some cases, they charge a percentage of the amount being transferred.»

- On March 19, 2021, changes to Nacha’s operating rules expanded access to same-day ACH transactions, allowing for same-day settlement of most ACH transactions.

- Nacha works closely with various government agencies and network participants, sets the rules, and the two operators then work together to route and deliver all ACH transactions accordingly.

- Start sending payment requests to your customers and when they pay you, funds will be sent to you by ACH to your bank account.

Whether ACH is right for you comes down to the needs of your business. A company that relies on monthly billing can save a lot of money by using ACH instead of credit cards. On the other hand, ACH may not make sense for a retailer without a lot of repeat customers. With HubSpot payments, you pay 0.5% of the transaction amount, with a cap of $10 per transaction. There are no monthly fees, setup costs, or hidden charges, so you only ever pay for the service when you need it. The last important difference is that ACH payments are reversible, while wire transfers are permanent.

- ACH transfers also help improve cash flow, as you always know when the funds leave or enter your account.

- ACH payments go through clearinghouses, are processed in batches, and are typically a low-cost way to transfer funds domestically.

- However, ACH transfers are typically used for domestic payments, while wire transfers can be used for both domestic and international payments.

- SpeedHistorically, wire transfers were usually faster than ACH transfers, but that’s not the case anymore due to changes to Nacha’s rules.

- ” A wire transfer is another method of electronically transferring funds, which means this system comes with many of the same benefits as ACH transfers bring.

Penalty for frequent transfers from savings

Real-time payments, however, can cost 1% of the amount transferred, which means that ACH costs significantly less, especially for larger transfer amounts. ACH fees are also much lower than credit card payments, which can cost between 1.5 and 3% per transaction. At no point do any two banks in the system exchange a stack of money or a pile of gold. Stripe customers can initiate ACH Direct Debits as a payment method. A customer provides their bank account information, and the business is able to pull funds directly from their account, either for a one-time purchase or a https://www.bookstime.com/ recurring payment. For businesses using Stripe, these ACH debits can be managed in the Dashboard.

Wire transfers are very fast, but costly, and ACH transfers are much slower, but have very low fees. PayPal business solutions make it easy to accept ACH transfers, along with other popular payment methods like credit cards, debit cards, PayPal, and more. Because a wire transfer is direct, it can be cleared within minutes, making it the faster way to send money. However, wire transfers can be costly, with banks charging both the sender and the recipient.

This is the type of ACH transfer used for payroll or government benefit programs (often referred to as “direct deposits”). The ACH Network is an electronic system that serves financial institutions to facilitate financial transactions in the U.S. In Q2 2024, the ACH processed over 8.4 billion payments, with a combined dollar value of over $21.5 trillion. ACH transfers can be a cheap way to move money, but if you’re the one sending funds, check out your bank’s policies first. This will help you avoid fees, unexpected processing delays and potential limits so you can make the most out of the service. Nearly every financial institution has a cutoff time for transfer requests; respecting those will help your money arrive on time.